Comparative Market Research - Renewable Energy - Comparing Seven countries - Current state and future challenges

1. The IPCC - International Panel on Climate Change, recently released its timely report on climate change and

global warming, a bleak snapshot of the current situation and a gloomy outlook

for the foreseeable future, including a reference to the Middle East region and

possible implications for our future and our children's future. [1]The

impairment of the sun's ability to return sun's rays back into space is

primarily attributed to emissions of gases that damage the texture of the

atmosphere.

2. The first report of "Intelligence

Club" hereby presents market

research that comprehensively reviews the existing and future state of the

renewable energy market in several European countries (Portugal, Germany,

Iceland, Austria, Norway), a major African country (Sudan), and an important

sultanate in the Middle East (Oman).

3. Alongside the reflection

of the current state in each

country, the countries are compared in different aspects, based on accepted

models.

1. We found that all the countries we analyzed have a state plan for developing

renewable energy-based infrastructure,

aiming at 2050 or under.

2. Addressing renewable

energy applications for the

benefit of agriculture development, we found that most countries designate part

of the energy supply in favor of agriculture, in Oman we found that there is a

dedicated plan for future development.

3. In analyzing the current situation, we found that most countries have identified

and exploited renewable energy sources in their territory. However, bioenergy

and geothermal energy are not the domain of all countries of comparison. Norway

is an exporter of natural gas while sudan does not know how to produce it

efficiently. We found that in Oman, there is a process of developing wind

energy, and in Sudan, there is a similar process aimed at geothermal energy.

Germany should be named the World's No.2 after China in biogas-based energy

production and utilization.

The data indicate that in the countries of comparison, geothermal energy and bioenergy

are an opportunity for domestic development and foreign companies and

organizations.

4. In analyzing the current

situation concerning the utilization of biodegradable energy sources, we realized that all

countries use at one level or another Fossil fuel as well as coal. Some

countries produce energy based on biomass, and Sudan still uses forest

trees as a basic energy source.

5. Analysis of main uses for renewable energy - it is evident that the emphasis is on

electricity generation as well as for heating and industrial purposes. Some

countries produce energy for land and sea traffic as well as agriculture, with

an emphasis on Sudan, which is its main industry. In addition, there is a

significant difference between the rate of renewable energy utilization and

electricity generation in the most developed countries in Europe (Norway for

example), and Sudan and Oman.

The data indicate that in the field of the transformation of maritime and land

and air transportation there is still great potential for development, which

constitutes opportunities for companies whose purpose is aimed at these areas.

6. Comparing the size of the

country to its population density, we found that although Sudan is a very large

country relative to the other countries,

followed by Oman and Germany, Germany Portugal, and Austria are the most

densely populated.

7. An examination of the cost

of electricity to households and

industry in the comparative countries shows that Germany, Portugal, and Austria

are the most expensive for the household consumer. The comparison also

indicates a clear difference between the price of electricity for households

versus industrial use of electricity. In Oman, we found that electricity for

the industry is more expensive than that of households. We understand from the

data that electricity prices are high, in part due to the broad regulation of

advanced countries regarding harmful emission quotas and the fact that Germany,

where the price of electricity is highest, still uses a large scale of non-renewable

energy sources.

8. And in the same context of the country's level of development and modernity, all

countries are in the range above 0.5 in the Human Development Index, at the

lower end lays Sudan,0.51, and at the top end there is Norway 0.957

9. We found that all countries, both the weakest and most developed, are related to UN

international activities, whether as contributors to knowledge and capabilities

or as recipients of assistance and guidance. This is also true of financial

assistance from UN institutions and regional finance organizations, such as

significant funds that Sudan receives from such entities and banking institutes

in Africa.

There is a clear difference between European countries, which are developed and

cooperate with organizations such as the UN for the purposes of generating and

passing knowledge and promoting projects, and African countries that are in a

very disadvantaged position relative to Europe, which get a lot of attention

from international aid organizations and large financing institutions. This

represents an opportunity for Western companies interested in investing in

renewable energy in cooperation with large organizations that can vouch for realistic

ROI.

10. Compiling the goals of the countries in compare, on renewable energy

development, we found that most state programs are looking 20-30 years upfront,

this is probably based on the feeling that the energy transformation takes

several decades to create a real market that relies mainly on, and perhaps

only, on renewable energy.

We found mutual key goals of reducing coal use, and emissions of toxic gases,

along with many countries' reference to the energy effects on poverty, gender

equality, costs for customers, and full electrification of all traffic. It

should be noted that Sudan, which is on this axis of development, is a long way

behind the rest, where we found that alongside the trend towards the

development of renewable energy, a five-year plan based on coal and fuel was

recently completed, with the clear aim of starting the country's industry (at

all costs).

11. We conclude from the data that the

two primary sources of renewable energy countries put first in development,

focus on solar and wind energy, followed by the development of waterpower

energy and all other sources with a lower priority. This finding represents an

opportunity for companies interested in developing their market with solutions

for this type of renewable energy. In the short term, we suggest focusing on

solar, wind, or hydraulic energy solutions. In the longer term, the

opportunities are with the other renewable sources.

(The full report is available for a reasonable fee)

Findings and insights

from the

countries' comparison based on

Michael Porter's "Diamond"

model:

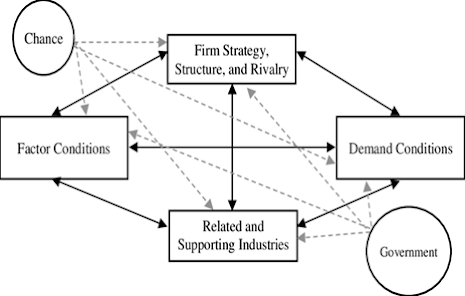

As mentioned above,

the main analysis model for

comparing the countries is a "diamond" model consisting of 6 criteria

for the country's level of competition (in fact 4 "corners" and to

which 2 more areas of influence were added).

In the

analysis of the countries, we

"dismantled" the state reports according to the 6 criteria above. In

addition, we extracted threats and opportunities the countries are facing. For

each of the criteria, a ranking of the level of competition was given in the

range of 1-7. In the last stage, the rankings of a particular country were summed

over the criteria, and a rough estimate of competitive state was given to all

seven countries.

1. Demand Characteristics -

Customer Sophistication Level - Sudan

1. Many customers are not connected to an electrical grid, and the consumption

for heating and cooking is mainly from perishable sources with an emphasis on

wood and biomass.

2. Gender disparities prevent the development of women and the home economy

and perpetuate the use of basic renewable energy sources for everyday needs.

3. Sudan's population is mostly rural and scattered, not connected to a major

power grid and therefore the goal is to produce local networks that will

provide the basic energy for living conditions, agriculture, and local basic

industry.

4. The west of the country is characterized by local power grids and independent

power plants and is mostly not connected to the state electricity grid.

5. Most of the energy in

Sudan comes from burning

consumables (wood, biomass) for cooking and heating.

6. The country is

experiencing a rapid increase in

energy demand from all sectors

2. Demand Characteristics -

Customer Sophistication Level - Oman

1. Oman's growth economy is characterized by the government's focus on non-oil

sectors. In addition, its population growth (GTR 2018) mainly contributed to a

steady increase in demand. According to Oman's 7-year statement from

procurement and water company (OPWP), the combined demand of MIS, DPS, and

other small and isolated systems may increase from 6,668 MW in 2017 to 10,072 MW in 2024 under its projected case scenario

for demand forecasts from 2018 to 2024.

2. Oman is fifth in production and at the peak of demand in the GCC region.

3. The MIS covers most of the northern parts of the sultanate, serves about one

million electricity customers, and consists of about 90% of the total demand

for Oman's peak electricity.

DPS covers the city of Salah and the surrounding areas of Dhafer Province,

serving about 100,000 customers and contributing 10% of peak demand (OPWP

2018).

3. Demand Characteristics -

Customer Sophistication Level - Iceland

1. Iceland's renewable energy

sources are not only plentiful,

relative to the size of the population, but they are also available at a

relatively low price. For this reason, electricity prices in Iceland are much

lower than in most other OECD countries.

2. The Icelandic electricity market allows all consumers - whether

individuals, businesses, public organizations, or industries that are intense

energy consumers - to choose their electricity supplier.

Transmission and distribution of electricity in Iceland remain under

concessional arrangements and regulatory oversight of the National Energy

Authority or ORKusto nun, under the Electricity Law and other relevant

regulations. The NEA oversees aspects such as pricing (income ceilings and

tariffs), quality, and supply security.

Under Icelandic law, one power company can function as a generator, distributor,

and supplier, however, an accounting separation is required between concession

(power transmission in a particular area) and competitive activity. While

consumers must use a distributor holding a concession to their region, the

distributor does not have to be the same company as the supplier.

Most of Iceland's electricity comes from less than a handful of manufacturing

companies, but there are also several small power plants that feed electricity

directly into a distribution system.

4. Demand Characteristics -

Customer Sophistication Level - Germany

1. Total energy consumption per capita is 2.7 percent

lower than the average 5 percent of the AA country average. Home and industrial

heating consumes over 50% of Germany's total energy consumption and is

generated from fossil fuels (25%) and is therefore responsible for about 40% of

carbon emissions.

2. Buildings: In Germany,

nearly 30 million structures are home

to more than 80 million people. Birth rates are low and there is no great

demand for new homes since the unification of the two countries, only nearly

20,000 homes a year. A significant portion of the energy consumption is not to

produce electricity, but central heating energy intended for heating houses and

buildings. Conversion to natural gas has helped reduce the emissions and

pollutants that this industry emits. As for the loss of energy, only upgrading

the structure can prevent it. Buildings are responsible for 40% of the

emissions, because of architecture and improper construction. Part of the

national energy building efficiency plan includes clogging nozzles and sealing

walls and roofs.

3. Transportation - A very small part of renewable energy production is

consumed by transportation. Germany has set itself a goal of becoming the

leading market and provider of electric mobility by 2020 as part of its

long-term vision for zero emissions in mobility. Although the electricity

market for transportation solutions is still in its infancy from a global

perspective, domestic demand for electric vehicles is on the rise, and with it

the growing demand for suitable infrastructure for charging vehicles and

innovative solutions in the field.

5. Demand Characteristics -

Customer Sophistication Level - Portugal

1. In 2019, electricity covered 25% of the total demand

for final energy, 56% of the demand for building energy, and 25% of the energy

in the industry.

2. Household consumers pay higher taxes than industrial consumers.

6. Demand Characteristics -

Level of sophistication of customers - Austria

1. Austria is stable on

producing 1,425 petajoules, with energy

demand at 1,362 petajoules 2005 and 1,350 petajoules 2016, and energy

consumption at the edge stood at 1,101 petajoules 2005 compared to 1,121 petajoules

2016.

7. Demand Characteristics -

Level of Sophistication of Customers - Norway

1. Norway is considered a young country, separated from Sweden in 1905. Norway is a

large country with a population of 64 in the world and is about 324,000 square

kilometers. Its population is about 5.5 million people in total. GDP per capita

is about $63,000 and the human development index is 0.957. This index

classifies Norway as the first in the world.

2. Internal renewable energy

customers concentrate on various

uses, heating and cooking 16% of renewable energy, 36% for transportation, and

48% for the industry.

3. In July 2020, electricity prices dropped below zero for one hour because of low

exports of electricity and the start of the summer holidays. Over the past 26

years, the population of Norway has increased by 22%, and the value of the

Norwegian economy has doubled. However, the final energy consumption on the

Norwegian continent increased by only 12% in the same period.

8. Ecosystem Characteristics

and Supply Chains - Sudan

1. Solar energy, the first in

development. It has been in

partnership with European companies since 2010.

2. Strong involvement of UN and African organizations to develop the solar field focusing

on irrigation and local electricity supply.

3. The country has 6 central

hydraulic dams that provide a very

high amount of energy to several parts of the country.

4. In the field of geothermal

energy, Sudan intends to learn

from Kenya, the neighboring country, how energy should be generated from this

source.

5. Sudan's energy industry is made up mainly of government companies and entities,

but there is supportive regulation that encourages cooperation with the private

sector and international bodies.

6. There are plans for

capital projects on hydraulic and

solar energy, but there are no suitable investors yet.

9. Ecosystem Characteristics

and Supply Chains - Oman

1. The small DPC system serves areas in the south, which also have

significant potential for wind energy.

The rest of the country is supplied by the AEC mainly through 395 megawatts of

diesel-based manufacturing plants.

2. Natural gas is Oman's main

fuel resource for electricity

generation and related desalination facilities, provided by the Ministry of Oil

and Gas in rural areas that mainly use diesel.

3. Nearly a quarter of Oman's

gas production is used as fuel for

desalination and water facilities, the rest consumed by the country's

industrial and petrochemical industries or sold for export. Due to the growth

of the economy in Oman, domestic demand is rising and therefore the government

feels the need to diversify its energy resources and ease the pressure on

natural gas resources that are already limited. To realize the government's

vision of long-term energy sustainability, Oman adopted its national energy

strategy 2040, which sets the following goals for the electricity sector:

renewable energy accounts for at least 10% of electricity output by 2025.

UP to 3,000 megawatts of coal production can develop by 2030.

Priority for improving the thermal efficiency of gas power plants.

Explored other sources of electricity generation.

4. The distribution and

supply of MIS (The Central

Energy Company in Oman) are carried out by three companies that own

subsidiaries of AHC, namely MZEC and MJEC.

Dhofar Power (DPC) owns, operates, and maintains the distribution network in

the Dhofar area of southern Oman. DPC is currently a distribution and supply

business entity operating in the Dhofar region.

10. Ecosystem Characteristics

and Supply Chains - Iceland

1. Iceland's most

rich energy

companies: Landsvirkjun owned by the Icelandic state. Orkuveita Reykjavíkur / Orka náttúrunnar

owned by municipalities. HS orca is owned by Canadian company Altera Power and a group of

Icelandic pension funds.

2. Landsvirkjun: The

state-owned

Landsvirkjun company is by

far the largest energy company in Iceland, providing about 75% of all

electricity produced in Iceland (12.6 GWh) a year from (16.8GWh). Landsvirkjun is responsible for more than 96%

of all hydro production in Iceland, and its share of electricity generation by

geothermal power is about 11% of the total.

Most of the electricity (80%) generated by Thesvirkjun is sold to high-energy

industries through long-term contracts. the remaining 20% is purchased by

public services and the operator of the Icelandic Gear System (TSO).

Founded by the Icelandic parliament in 1965, it is an independent legal entity

and has 100% state-owned, the Icelandic government guarantees all the company's

loans. The finance minister manages ownership of Thesvirkjun and appoints all

five board members and five alternative members. It currently owns 11 waterpower

plants and two geothermal power plants with a combined capacity of nearly 1,950

MW. Most of the capacity is in waterpower

(nearly 1,900 megawatts), while geothermal stations have a capacity of 63

megawatts. Landsvirkjun is also the main owner of Icelandic transmission system

operator (TSO), with a 65% share.

The waterpower plants of Landsvirkjun produce about 95% of the company's total

production, while geothermal power contributes about 5%. Landsvirkjun is accepting

much of its revenues with foreign currency, because of widespread electricity

sales to large foreign-owned aluminum nifts in Iceland. Therefore, the recent

economic turmoil experienced by Iceland has not affected Landsvirkjun almost as

much as most other Icelandic companies (the depreciation of the Icelandic

currency did not have negative effects on Landsvirkjun's income). Landsvirkjun

is one of Iceland's largest companies and now has more equity than any other

Icelandic company.

3. Orkuveita Reykjavíkur /

Orka náttúrunnar: Orkuveita Reykjavíkur (OR), is a public service company that provides electricity and

hot water for heating. It is the largest local electricity and heating provider

for end users. The company's main service area is the Great Metropolitan Area

of Reykjavíkur. ORs on power generation stations have a total capacity of

nearly 450 megawatts. Most of the electricity from OR is generated in two geothermal factories

that utilize high-pressure steam. Their capacity is 303 megawatts (Elliðaárstöð). In total OR generates nearly 3,000 GWh of

electricity a year.

Besides, it operates an extensive sewage system for the Reykjavik area, as well

as several nearby municipalities.

Each year OR produces and distributes about 85 million square meters of thermal

hot water (for heating an entire district, swimming pools, and industries). The

water from OR comes from low-temperature fields in the city and nearby, and the

heat and power stations are integrated into the Stations of Nessjavellir and

Hellisheiði. Coldwater is collected from reservoirs outside Reykjavik. Running

geothermal heating companies starts in the 1940s. The city of Reykjavik is the

largest owner with a 93.5% stake.

4. HS Orca: HSOrca is Iceland's third power generation company, and

until 2007 it was a publicly owned Icelandic state-owned company and few

municipalities in southwestern Iceland. HS Orka operates two geothermal power

plants, the Svartsengi station, and the Reikines Station, with a total capacity

of 175 MW and generates about 1,350 GWh a year. HS Orca is also a major hot

water supplier and owns several subsidiaries, including a third of the

well-known Blue Lagoon.

5. There are a few other small companies and services in Iceland such as HS

Veitur, Norðurorka, Orkubú Vestfjarda, Orkuveita Húsavíkur, Rarik, and several

other small companies.

6. Importers and fuel distributors:

Iceland currently imports all its hydrocarbon fuel, although there is a

possibility of finding hydrocarbons on the Icelandic continental shelf soon. Several

companies are specializing in importing and selling gasoline, diesel, and other

oil products. The three main companies are Skeljungur, N1 and Olíuverslun

Íslands (OLÍS). Skejljungur uses the Schell brand, while N1 and OLÍS use their

local brands. OLÍS and Skeljungur also operate self-service retail (under the

orkan brands).

Previously, all three companies listed above had franchise contracts with three

of the world's largest oil companies: Shell, Esso (Exxon Mobil), and BP. Today,

however, Skeljungur is the only fuel retailer in Iceland that is still involved

in a franchise partnership (with Shell). Therefore, foreigners traveling around

Iceland will not recognize many well-known international fuel brands.

7. Iceland has one common

electrical transmission system operated

by Iceland's transmission system operator (TSO).

8. Iceland's market for electricity and supply production is under European

Economic Area (EEA) rules. The EEA is based on a legally binding multinational

economic treaty between the European Union (EU) and Iceland, Norway, and

Liechtenstein.

9. Just as in the European Union, the transmission, distribution, and sale of electricity in Iceland are subject to concession arrangements and specific regulatory oversight.

11. Ecosystem Characteristics

and Supply Chains - Germany

1. Germany exports - more than 36% of Germany's electricity output comes

from renewable energy sources - up from just 6% a decade ago.

2. Export technologies: Germany is helping Saudi Arabia

move to use renewable energies and abandon its dependence on oil by funding the

construction of an electrolysis plant in its territory, which will be used to

generate electricity free of polluting fuels.

3. Supportive industries – Large energy aggregation systems will play a

significant role in Germany's future energy infrastructure, even in the safe

integration of the large quantities of solar and wind energy in the existing

network.

4. Supportive technologies – In terms of long-term energy storage solutions, Germany

has recently increased interest in Power to Gas technologies, and these

technologies convert excess electric energy into gaseous fuels such as hydrogen

and are included in the German government's energy storage and fuel strategies

and future mobility.

12. Ecosystem Characteristics

and Supply Chains - Portugal

1. The Portuguese initiative includes professional exposure to the issue,

conferences, and drafting a joint statement to move forward the issue with a

regional joint commitment.

2. All oil,

natural gas, and coal

utilized for energy in Portugal are imported.

3. Funding, the EU's economic

recovery gives Portugal a valuable

opportunity to achieve its ambitious energy and climate goals for 2030. The

main areas: capital-intensive programs related to energy efficiency in

buildings and industry, the deployment of renewable electricity generation and

support for infrastructure, electrification of transportation, buildings and

industry, and the production of sustainable biofuels and hydrogen.

4. In August 2020, EIF and IFD launched PORTUGAL BLUE, a capital investment

of EUR 50 million aimed at fostering the blue economy ecosystem in Portugal,

providing financing to startups, SMEs and Midcaps through venture capital and

private equity funds.

5. Private

operators of two

coal-fired power plants have announced that these plants will be permanently

closed in 2021.

6. In 2019, total

public and private expenditure on energy research and development was 0.07% of GDP.

7. In 2018, the government

established a working group to

analyze Portugal's tax system and ensure its alignment with the transition to

carbon neutrality.

13. Ecosystem Characteristics

and Supply Chains - Austria

1. Austria invests in strong and dynamic renewable energy infrastructure and

optimization for existing infrastructure.

2. Creating a safe

environment for investment in

renewable energy projects.

14. Ecosystem Characteristics

and Supply Chains - Norway

1. Supply chains start in Norway and continue to Europe in a

special pipeline built to transport oil and gas - these markets have risen and

declined over time and have often experienced as much upheaval as in 2016 as

oil prices fall.

2. Norway is part of the

inter-Nordic system, which includes

Sweden, Finland, and eastern Denmark.

3. Norway's transmission

systems company, in collaboration

with Dutch network company Tennet, completed Nordlanek in December 2020, which

is an underwater cable of more than 500km,1,400 megawatts linking the Norwegian

and German electricity market directly for the first time.

4. The North Sea Link, which is about 720km with a capacity of 1,400

megawatts, will connect the Norwegian market and the UK. Completion of what

will be the world's longest underwater link is expected later this year.

Overall, the capacity of connections between the Nordic electricity system and

other systems is expected to increase by more than 50% by 2025.

15. Market Strategy and

Structure of Competition - Sudan

1. Sudan's energy market is largely centralized and under government supervision.

2. Since the state itself is not strong enough in knowledge and budgetary

sources, most of the energy-themed competition is from external companies

interested in investing in projects.

3. The market is growing, and its strategy consists of internal and international cooperation

in favor of developing and promoting projects.

16. Market Strategy and

Structure of Competition - Oman

1. The country's largest

network is the connected central system (MIS), which contains 17 power generators.

2. The MIS is providing electricity to The Capital and six

other provinces, mainly in the north of the country, and its water network

covers Muscat, el Batina North, El Batina South, El Dahiliyah, and Boreimi,

with plans to add El Dhara to this list.

3. OPWP has announced plans to phase out three new solar energy installations and

two new wind energy projects, aimed at providing a total of about 2,500 megavolts

of renewable-based capacity including a 50-megawatt wind power project. (And in

the Helenian Islands) until 2024 (OPWP

2018).

The first independent power generation project (IPP), the 500MW Ibri II Solar

IPP in Villayat Iberi in El Dheira

province, is expected to run until 2021. The OPWP expects solar projects to

contribute at least 30% of their installed peak. Possible locations for new

wind energy projects include Deoper and Dokum.

17. Market Strategy and

Structure of Competition - Iceland

1. Iceland is the world's

largest producer of energy per capita and the largest electricity producer per capita, with about

55,000 kWh per person per year. By comparison, the EU average is less than

6,000 kWh.

2. A license granted by the

National Energy Authority is

required to build and operate an electric power plant. The National Energy

Authority is responsible for monitoring and regulating the compliance of

companies operating under issued licenses.

3. The government outlined a plan that examines the economic feasibility and

environmental impact of each project before it is approved.

18. Market Strategy and

Structure of Competition - Germany

1. Sophisticated energy market - starting in 1997, Germany's electricity market

has officially opened to competition, following EU regulations.

2. Market structure: In Germany, there is a separation

between electricity transmission and electricity supply for homes, which helps

develop the renewable energy market.

3. Legislative reforms have funded energy sources and created competitiveness

and competitive prices. In 1990, Germany passed a law to pay for the supply of

electricity to the electricity grid from small producers who are also

consumers. This is a transition from a centralized energy network - to the

Internet of energy, a decentralized power grid in which anyone can be a

consumer and a manufacturer. Germany encourages the production of renewable

energy not only through business players but through as many citizens as

possible. It pledges to buy green electricity in long-term contracts at prices

that guarantee a return on investment, in addition to a series of legislative

actions and massive investments in the development of green technologies and

the development of industry concerning renewable energy.

4. Energy production: The renewable energy market is developing rapidly. In

2020, the total renewable energy supply was 42.2 Toe and 227 Twh, which is

14.1% of total initial energy supply (TPES) and 35.3% of the total electricity

generation from renewable sources.

5. Renewable electricity generation, 70% of renewable electricity production is

in private hands; manufacturers are farmers, communities, and cooperatives;

only 6.7% of the renewable energy market is in the hands of the big four

companies.

6. Strategy:

The goal of the German Energy Agency's (Energiewende)

program, is streamlining the German energy system, whose sources are mainly

supplied from renewable energy, without nuclear power generation (17 stations),

by 2022, and without the use of coal, which is the main source of energy, by

2038.

7. Taxation: German

households pay $353 per megawatt for

electricity, the third-highest rate among IAAF countries. Taxation accounts for

48% of the electricity price, and heavy industries pay less than households.

8. Goals: Germany sets

ambitious goals for reducing energy

consumption, including streamlining production and transmission by 50%, cutting

CO2 emissions by 80%, and increasing the share of renewable energy to 60% of

total energy consumption by 2050, which is conditional on the capacity of the

electricity grid infrastructure.

19. Market Strategy and

Structure of Competition – Portugal

1. In 2019, external energetic sources dependence was 74%.

2. In November 2020, electricity and gas social tariffs were amended to

cover all unemployment situations.

20. Market Strategy and

Structure of Competition - Austria

1. Strategy - encouraging individuals, and companies in the private and public

sectors to develop means of creating renewable energy, state programs, and

state goals.

2. In 2016, renewable energy accounted for 33.5% of the country's total energy

production.

3. Encouraging the production

of solar and renewable energy in local

households.

21. Market Competition

Strategy and Structure - Norway

1. From a poor country

compared to its neighbors, Norway in

the 1960s slowly became an oil and gas powerhouse, with the discovery of oil

and gas in the sea, north of the country. The largest oil field was discovered

in 1969 at the time of the eruption of the energy crisis following the Arab

embargo in the 1970s, and today 20% of Europe's oil and gas is supplied by

Norway.

2. Norway is a very rich country, the energy market depends on the oil and gas

deposits, Norway knows it needs to be ready for the day after the exhaustion of

the reserves, it is a competitive and capable country that supplies electricity

to Europe.

3. Norway has the lowest carbon emissions in Europe.

4. Norway has 1,681 water

powerplants, which in 2020 provided

88% of the electricity supply.

5. Norway has energy stockpiling technology, so it doesn't depend on

climate change.

6. In the second half of

2020, Norway exported 14 TWh of

electricity, making it the largest electricity exporter in Europe.

7. Norway has developed a prototype turbine, which served as the base for the

Hywind wind powerplant off the coast of Scotland, the first to go into

commercial production. construction of the 88-megawatt Hwind Tampen

project began in October and is designed to provide 35% of the annual power

needs of five platforms in the Gullfaks oil and gas fields. Norway's coastline

is known for its stunning deep waters and fjords, but there are also possibilities

for conventional wind energy utilization by building wind turbines.

22. Characteristics of the place and area of the industry: Sudan

1. North Sudan is Africa's third-largest country, the country is

relatively young and has suffered for many years from internal tensions and

brotherly war.

2. The country is rich in

minerals where biodegradable and

renewable energy can be produced, as well as solar and wind potential.

3. For the benefit of solar energy– the state is in the equatorial area, thus having

many sunny days a year, and a very high level of radiation most of the year.

4. In Sudan, there is a high potential for waterpower to be used to produce

much energy. The country designates this source for creating power grids in

areas where the state grid does not reach.

5. Wind energy is highly served in the sea and mountains, and wind

energy is favored for development, both to provide electricity to remote regions,

and as an engine to stimulate the country's entire renewable energy industry.

6. Regarding natural gas, there are very large deposits of gas, but the state

doesn't know how to take advantage of it. Most of it is wasted during the

process of mining fuels.

23. Characteristics of the Place and Area of the Industry: Oman

1. The maximum demand for the OETC transmission system is usually on summer

weekdays.

2. Demand typically peaks in May to July, with the highest day temperatures

and the most intense use of air conditioning units.

Seasonal demand is expected to decline with new large industrial loads coming

to the grid.

24. Characteristics of the place and area of the industry: Iceland

1. Natural hydrothermal

resources have made Iceland the

world's largest green energy producer per capita.

2. Currently, hydrothermal

resources supply almost 100% of

Iceland's electricity consumption and about 85% of total initial energy

consumption. Of all initial energy consumption, about 20% comes from waterpower

and 65% from geothermal sources. This is the highest share in the world of

renewable energy in any total national energy budget.

3. The untapped economic

potential for waterpower and

geothermal power will continue to be Iceland's main source of growth. The total

ability to generate the potential of Icelandic hydro-geothermal resources is

estimated at 50TWh a year.

4. Iceland has yet to realize its potential energy of wind, which could be

important to the economy in the future.

5. The green-fuel sector is small but growing. It produces bio-methane and

green methanol, but for the most part, Iceland still imports almost all the

fuel needed for vehicles, shipments, and planes, which may change as the

international oil and gas industry is now taking the first steps in the search

for hydrocarbons on the Icelandic continental shelf.

25. Characteristics of the place and area of the industry: Germany

1. Total electricity generation in Germany is 644 Twh, a total energy source

segment is: 37% coal, 12% nuclear, 13% natural gas, 1% oil, 17% wind, 9% bioenergy,

7% solar, 3% hydro, 0.5% geothermal.

2. Wind source: Germany has more than enough renewable energy, but this

is scattered over a wide area, and not concentrated in one place, most of the

electricity from a wind source is produced in northern Germany and most of the

demand for consumption is in cities and industrial centers in the south and

west of the country.

3. About

1.6 million solar farms with a total capacity of 43GWp

have been installed in the last 27 years in Germany.

4. The energy efficiency boom has created nearly a million jobs in Germany in the

past 20 years, exporting the knowledge they have acquired and the products they

have developed to meet energy efficiency standards such as developing systems

for monitoring the loss of compressed air, and adaptations to existing electric

motors.

26. Characteristics of the place and area of the industry– Portugal

1. Climate impacts pose a threat to waterpower generation in Portugal.

2. There is no domestic

production of oil, coal, or natural

gas. 100% of the fuels supply is imported.

3. The main program supporting industrial energy efficiency is SGCIE, which requires

energy audits and strategies to reduce energy requirements from high-energy

facilities.

4. 70% of the

country's total electricity is generated from more renewable and environmentally friendly energy,

and in recent years the state has managed to reduce the use of coal by 29%.

5. The National Hydrogen Strategy (EN-H2) sets a target for

hydrogen derived from renewable energy to cover 1.5-2.0% of Portugal's energy

consumption by 2030, with industrial use, maritime and land transporting, and

injecting into the natural gas grid.

27. Characteristics of the place and area of the industry: Austria

1. Austria also has the

option of using hydro and water

sources, solar energy, and power plants.

28. Characteristics of the place and area of the industry: Norway

1. Norway is the largest exporter of Solomon fish to the world, probably because it

relies on the oil industry, Norway has not developed in other areas besides fish,

oil, and wood products.

29. Government's Influence on

Industry: Sudan

1. With the decision to

develop the renewable energy market,

responsibility was transferred to the Ministry of Water, Irrigation, and

Electricity, which have historically been responsible by the Ministry of

Agriculture and Forests.

2. The state enacted two basic energy laws that encourage investment and

cooperation.

3. The state adopted a policy

decision to support and subsidize

the industry when it comes to developing new energy sources, an emphasis on

solar energy for agricultural purposes.

4. The state implemented a five-year plan for reducing poverty in 2015-2019 by

making energy accessible to the population.

5. The updated energy

development plan until 2031 is mainly

about narrowing the gap between demand and supply in the country, and with an

emphasis on coal-based power plants alongside the maintenance of hydraulic

power plants.

6. The state provides large subsidies and grants to companies

interested in developing the energy market, and in the meantime, the price of

electricity in the country is very low, and the state burdens itself with many

costs, which create concerns for overseas investors to produce capital-intensive

projects that will not return themselves with a reasonable marker.

7. In addition, the state has formulated a roadmap for

achieving three national energy targets, from which 69 direct actions are

derived.

30. Government's Effects on

Industry: Oman

1. The sultanate is looking

to manage its energy transition and

inject capital into its fiscal balance sheet. privatization, sector

restructuring, and renewable energy are key issues on Oman's services sector

agenda. Reducing reliance on natural gas is a priority, with several

large-scale solar-power projects, helping the country achieve its goal of 30%

renewable energy on the grid, by 2030.

2. Due to the government's

desire to expand reforms in the

electricity market, Oman is expected to allow open access to its transmission

network and generators.

Such developments may support the country's ongoing efforts to develop a

well-functioning regional electricity market. Moreover, when peak electricity

demand in Oman usually occurs in May and June, while peak demand in most

neighboring countries in July and August, Oman will have an opportunity to

trade electricity in the GCC region.

31. Government impacts on the industry:

Iceland

1. Iceland is a member of the European Economic Area (EEA). Under Icelandic law

and regulations, businesses and industries are generally open to foreign

investment.

2. As an example, a Canadian company recently acquired a large stake in one of

Iceland's largest energy companies through a legal entity owned by a Canadian

company in Sweden.

In addition, the Icelandic Trade Minister has the right to grant legal entities

(except those mentioned above) a license to operate in Iceland. This includes

approval for investment in the energy sector. Canadian electricity investor

Alter Power and Chinese chemicals company National Bluestar also own large

business units in Iceland through their Scandinavian subsidiaries.

3. So far, most of these

investments have been in high-power

industrial production, particularly in focus on metals. however, there is a

growing investment in medium-sized industries with foreign companies investing

in data centers and dynamic tech companies.

The reasons behind such foreign investment can vary. The low cost of

electricity is the most important factor for high-energy industries such as

aluminum sprinkling. Skilled labor and highly qualified technical people in

Iceland's educated society are also important factors. Moreover, Iceland has a

modern and efficient infrastructure, and the Icelandic corporate tax rate of

20% is one of the lowest in the OECD. Some local authorities have flexible

development strategies, and incentive programs, which can be an advantage for

new investors. Government ministries in Iceland are usually very accessible,

allowing businesses and individuals to deal with them directly.

Examples of well-known international companies with a strong presence in

Iceland are aluminum producers Acoa, Century Aluminum, and Rio Tinto Alcan, and

Chinese chemicals company China National Bluestar (owner of Norwegianprosilicon

makerElkem). Below is a brief description of some foreign investors using

Icelandic energy.

4. Potential investors from outside the EU or EEA should get

special permission from Icelandic authorities, which, for example, applies to a

Canadian company that purchased shares in an Icelandic electricity company

through a company registered in Sweden.

There are, of course, a few law firms in Iceland that specialize in helping

foreign investors with legal matters, company establishment, and contractual

formality.

5. Icelandic Parliament adopted a general law on incentives for an initial

investment in Iceland (Law No. 99/2010) This new legislation has been approved

by the EFTA Supervision Authority (ESA) as a legitimate state assistance

program (this is important because of Iceland's membership in the EEA Economic Area).

Government authorities are entitled to give general and regional incentives for

new investments in Iceland up to a set ceiling, In addition to certain tax and

billing violations, incentives can also come in the form of direct cash grants,

training assistance, and land leasing.

As a member of the European Economic Area (EEA), Iceland has access to EU research funds for

research and development programs and joint ventures with companies from at

least one country (including all countries within Europe).

32. Government Impacts on

Industry: Germany

1. The main policy focuses on the deployment of renewable energy measures

and includes specific support policies for electricity, heating, and

transportation, as well as policies that support energy efficiency mainly in

the construction sector and more generally on climate change.

2. Investment in

infrastructure – The expectation is

for a steady increase in the state's need to invest in offshore wind stations,

photovoltaic energy, the expansion of networks and energy storage projects, and

the implementation of a smart new energy infrastructure that will be able to

balance the changing supply of renewable natural resources.

3. Germany added only 178

wind turbines with a capacity of 591

megawatts in the first half of 2020. The government decided that wind power

should increase by about 1.7gigawatts annually to help Germany reach the green

power target of 65% by 2030.

4. Research and development – Germany invests heavily in the development and

research of new technologies. Total expenditure on R&D is $1 billion a

year, which is 0.03% of its GDP. The state should now focus on developing

energy storage measures and finding suitable storage solutions that will reduce

the dynamics that characterize the production of renewable energy and ensure a

regular supply of electricity over time.

5. Emissions targets: The government has identified a need for reform in the

areas of transportation and heating buildings to meet emissions targets.

6. Upgrading buildings: The German government is currently encouraging the

upgrade of private buildings through green certificates and easing the renter

law. By 2017, approximately 80,000 households and commercial companies have

already invested in photovoltaic systems. Even the reinstallation of storage

facilities is expected to be a major growth engine in improving energy

dependence on private households and commercial companies. Only 3.7% of the

solar panels installed on rooftops in Germany are currently equipped with a

battery – a rate that by 2030 can reach over 80%.

7. Transport upgrade: The German government has decided to require the country's

gas stations to provide charging for electric cars, and the government will

invest $2.8 billion in developing electric battery production infrastructure

and charging infrastructure.

33. Government impacts on the industry:

Portugal

1. The government aimed at reducing the use of coal. Natural gas for electricity

generation will last until at least 2040.

2. The Green TaxAct, passed in 2014, to better regulate the taxation of the

energy sector with carbon targets - a key aspect of energy and climate policy.

3. The government has

developed a national strategy for

bicycles and active mobility to provide financial incentives for the purchase

of electric bicycles (including bicycle chargers).

4. Portugal was

among the first countries in the world to set a carbon neutrality target in 2050, mainly through widespread

electrification of energy demand and rapid expansion of renewable electricity

generation, along with increased energy efficiency.

5. The government is also

working at the international level

to increase power connections with Spain and the rest of Europe, which will

help increase the security of the electricity supply.

6. Funding for support comes from the state budget and some national funds

focused on energy and climate priorities.

34. Government's Effects on

Industry: Austria

1. Many companies decide to invest and adopt new directions in favor of

switching to renewable energy.

2. The state Invests to

create a change in leading

infrastructures to adapt the industry to them.

3. One of the most prominent

renewable energy laws is called the

Green Electricity Act, which regulates the promotion of the transition to green

energy against multiple suppliers that promote renewable energy and receive a

reward through any customer who uses the service.

35. Government impacts on the

industry: Norway

1. In recent years, the

government has begun taking steps to ensure the country's future, as its fuel and gas inventories are dwindling.

2. The government has plans for the electric vehicle sector. Starting next year,

every vehicle purchased will be electric.

3. In the field of wind and waves, Norway has a five-year plan and a decade.

4. Norway is starting a

process of increasing the use of

renewable energy, entering energy storage technology, and developing the use of

hydrogen by electrolysis or other technologies.

5. Oil and gas exports

produce jobs, and the country

needs to create replacement jobs for its citizens.

6. To care for its citizens, Norway has built a safety net from taxes and

dividends.

36. Wide effects affecting

competitiveness: Sudan

1. The country is in the very

early stages of developing the

energy market. Therefore, the starting point of the players in the energy

industry is similar, which creates great competitiveness.

2. There is a great deal of

involvement by international entities

and large investment bodies to help the state develop the energy market.

37. Wide effects affecting

competitiveness: Oman

1. In Oman, the

regulatory structure of energy production entities is structured from the supervisory entities,

the main ones being the Electricity

Regulation Authority (AER), which is the independent regulator of the electricity segment.

The Ministry of Oil and Gas (MOG), which is the policymaker of the electricity segment, and the

Public Water Authority (PAW), which is the regulator, water policymaker, and water

distribution company.

2. In October

2018, the sector began a restructuring process following recommendations from an energy

laboratory organized by the National Economic Diversity Improvement Program,

known as Tanpa.

(The AER) will remain as it is, given that Oman believes in the independence of

regulators when the water regulation may also be transferred to the AER and becomes an

authority for the regulation of electricity and water. The rebuilding movement

is intended to streamline the government, as there has been an oversupply of

public authorities with interests in the sector.

38. Wide effects affecting

competitiveness: Iceland

1. Electricity prices in Europe and around the world will

continue to rise, the Icelandic energy industry will continue to be even more

competitive than it already is; it seems that this development is already

underway and can be expected to gradually increase both profits in the

Icelandic energy sector and be a strong incentive for further investment in the

industry.

2. It is important to

remember that although Iceland has

the potential to significantly increase renewable energy production, hydro-geothermal

power sources are limited, so early investors will have the best choice in

Iceland's low-priced green energy potential.

3. The Icelandic TSO (Landsnet) has a few large development

projects already in the planning or planned stages for the coming years. The

projects are designed to meet the customer's needs and ensure that the network

has sufficient capacity to meet the minimum requirements, considering the cost

efficiency and economic principles set out in Icelandic law.

The network plan describes all the development projects of the transmission

system, whether at the proposal, planning, or construction stage. It also maps

all major projects in development stages based on memorandums of understanding

or the potential future development of a power trade market, even in the

absence of a specific time requirement to strengthen the network.

4. Compared to other countries, whether in the EEA, EU, or OECD, electricity

prices in Iceland are very low. This applies to both industries and households.

Due to the increase in electricity prices in Europe, the price gap is

increasing, making Icelandic electricity even more competitive than before.

This development allows Iceland and Europe to be connected via an underwater

cable. This option is currently being examined by the Icelandic National

Electricity Company (Landsvirkjun) and TSO Icelandic (Landsnet).

5. In some cases, this creates opportunities to simplify the current

transmission network and stop the use of elevation lines along mountain roads

where the weather conditions are severe.

39. Wide effects affecting

competitiveness: Germany

1. Energy security: Germany has multiple oil supply

sources, supply infrastructure, and emergency repositories that provide it with security. It also has confidence in

the supply of natural gas from Russia. The transition from producing energy

from coal and nuclear will require a lot of gas supplies in their place.

40. Wide effects affecting

competitiveness: Portugal

1. All services sector and public buildings must be audited to obtain an

energy certificate.

2. Multi-local regulation is the adoption of European regulation that on the one

hand limits the use of renewable energy in the country and on the other

encourages innovation and development of renewable energy sources.

41. Wide effects affecting

competitiveness: Austria

1. Entrepreneurs and private companies encouraged by the government in all sectors

and all areas place Austria with a competitive advantage over most ECD

countries and outside it.

42. Wide effects affecting

competitiveness: Norway

1. Norway is characterized by excess electricity generation and probably also imports nuclear energy.

Ranking the competitiveness of the countries according to the criteria of the "Diamond Model" (Porter)

|

|

strategy |

demand |

Ecosystem |

Place and area |

Government involvement |

Wide effects |

Weighted score |

|

Sudan |

5 |

7 |

5 |

1 |

4 |

3 |

25 |

|

Oman |

6 |

3 |

4 |

6 |

6 |

6 |

31 |

|

Iceland |

4 |

1 |

1 |

2 |

3 |

2 |

13 |

|

Germany |

2 |

2 |

2 |

3 |

1 |

4 |

14 |

|

Portugal |

7 |

5 |

6 |

5 |

2 |

1 |

26 |

|

Austria |

3 |

6 |

7 |

4 |

7 |

5 |

32 |

|

Norway |

1 |

4 |

3 |

7 |

5 |

7 |

27 |

In the country's strategy

and competition structure criterion,

we found that Norway is the most competitive country.

In the criteria for place and area attributes, we found that

Sudan is the most competitive country.

In the criteria of government's influence over the competition,

we found that Germany is the most competitive country.

In the criterion of wide effects and phenomena that affect the

competitiveness of the country, we found that Portugal is the most competitive.

Competitive ranking relative to the compared countries

|

country |

Competitive rating |

|

Iceland |

1 |

|

Germany |

2 |

|

Sudan |

3 |

|

Portugal |

4 |

|

norway |

5 |

|

Oman |

6 |

|

Austria |

7 |

By simply weighing all the

criteria (without any special

weight for any criterion), we found that Iceland leads at its level of

competitiveness relative to the other compared countries. that is, Iceland has

the best conditions that allow it to conduct itself competitively and even

profitably (currently), against the other countries of comparison.

Major threats facing the comparison countries

1. Knowledge gaps: We

identified a wide spectrum of knowledge

gaps across the entire value chain of mining, extraction, and energy transmission.

The spectrum refers to each country by its position on the chain.

2. With the lack of full

energy connectivity to all parts of the country, some countries have not yet been able to connect

all residents to a central electricity grid.

3. Sensitivity to climate impacts: Most comparable countries are in areas where

climate change in the world is manifested or at risk of manifestation,

especially in wind power and waterpower the situation is even more sensitive.

Notable opportunities for the renewable energy market in the compared countries

1. In most of the countries, there is energy security for all citizens and

industry, noting that Oman and Sudan are not there yet, but the plans are aimed

at exactly that level.

2. Most countries are rife

with renewable and Consumable

energy sources and reservoirs which greatly enhances the country's potential-supply

curve; it is important to note that Portugal does not provide itself with all

the energy it needs, with an emphasis on Consumable energy, while Germany and

Sudan are heavily dependent on their economy for the exploitation of abundant consumable

energy.

3. A few countries analyzed

in the study, are world leaders

in the areas of information and knowledge on conversion and transmission of

renewable energy. This contrasts with other countries which consider this is a

gap. This may act as a trigger for cooperation between them.

4. We found that a few European countries analyzed in the study are exporters of renewable energy, which greatly enhances their competitive position in the international market.

----------------------------------------------------------------------------------------------------

"Intelligence

Club" is a framework by Webintelligency.

Webintelligency is a Corporate Intelligence & Intelligence Training

services company. We are interested in all types of organizations and know how

to deliver quality and reliable intelligence reports, in a reasonable time. For

more information and inquiries, please contact us at: webintelligency@gmail.com

Comments

Post a Comment

Thank you for your comment

Visit our site www.webintelligency.co.il